Child Tax Credit 2024 Qualifications Requirements

Child Tax Credit 2024 Qualifications Requirements – Changes in legislation expanded the spectrum of families that can access credit.. With tax season right around the corner, many parents are anxious to know how much their child tax credit (CTC) will . Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. .

Child Tax Credit 2024 Qualifications Requirements

Source : www.visualcapitalist.com

Child Tax Credit 2024 Eligibility: Can you get the child tax

Source : www.marca.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

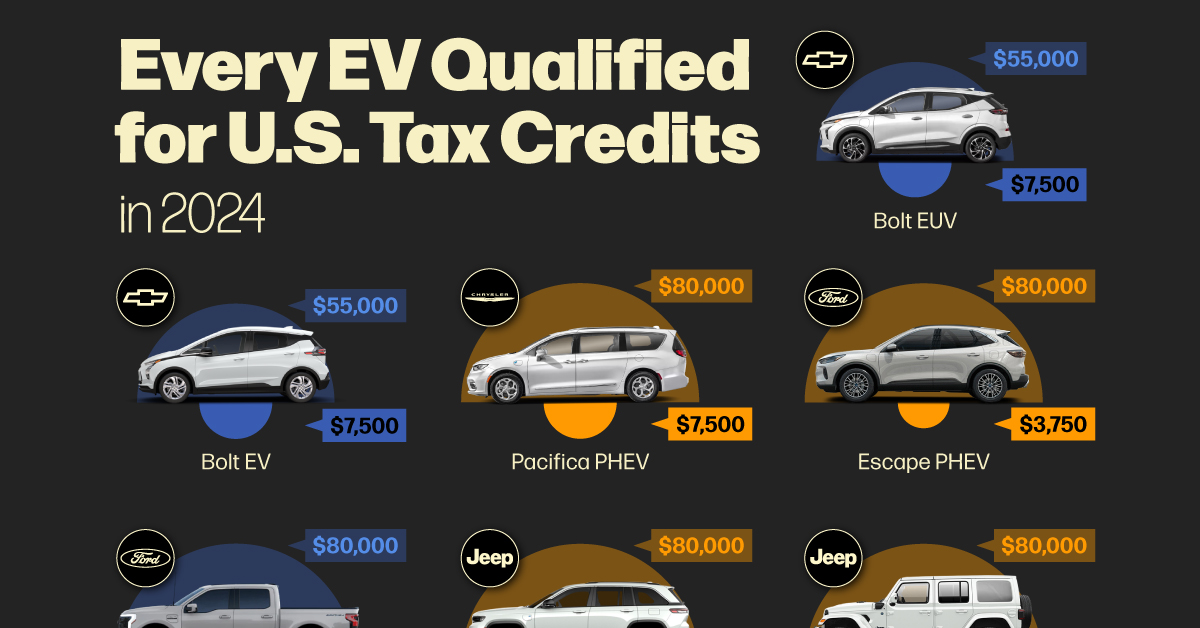

Every EV Qualified for U.S. Tax Credits in 2024

Source : www.visualcapitalist.com

Child Tax Credit 2024: Eligibility Criteria, Apply Online, Monthly

Source : ncblpc.org

Child Tax Credit 2024 Apply Online, Eligibility Criteria

Source : matricbseb.com

US Child Tax Credit Changes 2024: What are the changes and What’s

Source : www.incometaxgujarat.org

Child Tax Credit Boost in USA What Can be the Increase in Child

Source : matricbseb.com

EV tax credit rules in effect, more than 20 models lose eligibility

Source : www.cbtnews.com

Child Tax Credit 2024: Will there be a Child Tax Credit in 2024

Source : www.marca.com

Child Tax Credit 2024 Qualifications Requirements Every EV Qualified for U.S. Tax Credits in 2024: Here’s how a proposed change in the rules for the child tax credit impact tax refunds and the upcoming tax season. . Low-income parents stand to benefit the most from proposed Child Tax Credit increases for the 2023 tax season — and their savings could add up to thousands depending on how many children they have. .